Inspirating Tips About How To Develop A Home Budget

How to create a budget to beat shrinkflation.

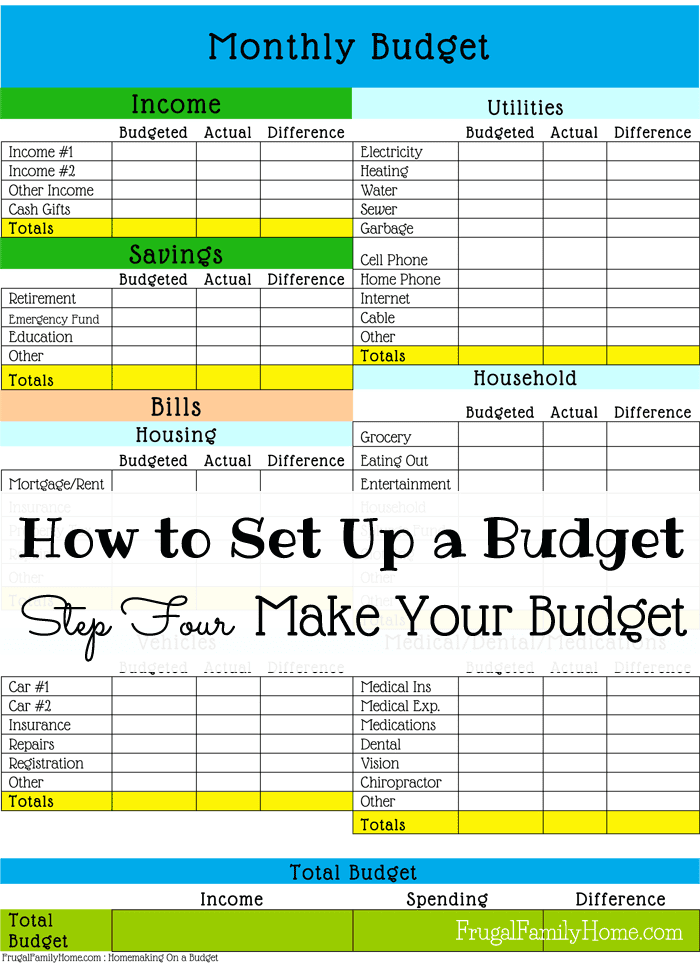

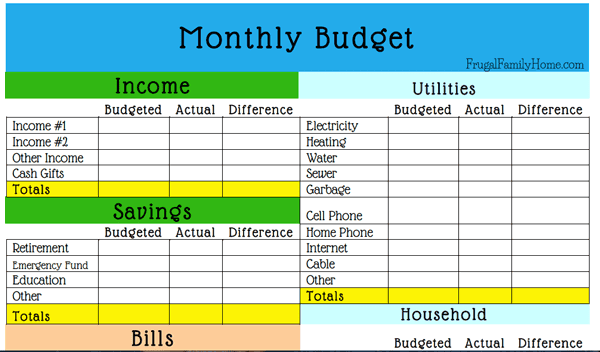

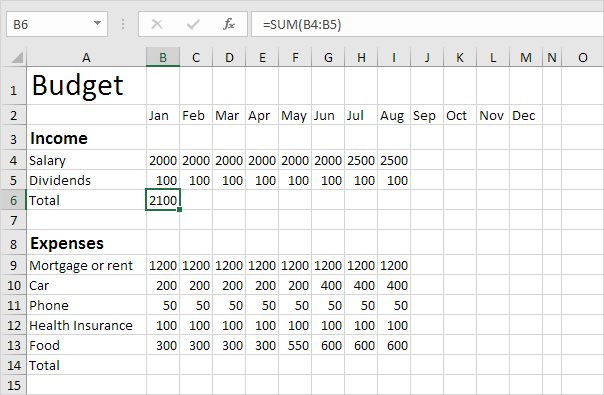

How to develop a home budget. List your income, savings and expenses. One popular budgeting strategy is the 50/30/20 rule, which separates your spending by category: Enter the amount of income, savings and expenses into each category of the.

“when you’re putting a budget together it’s important to make sure that you’re being realistic and that the numbers work,” van. Record your income record how. Pick a tool for documenting your household budget (find tools here) the key here is to be able to work quickly and have.

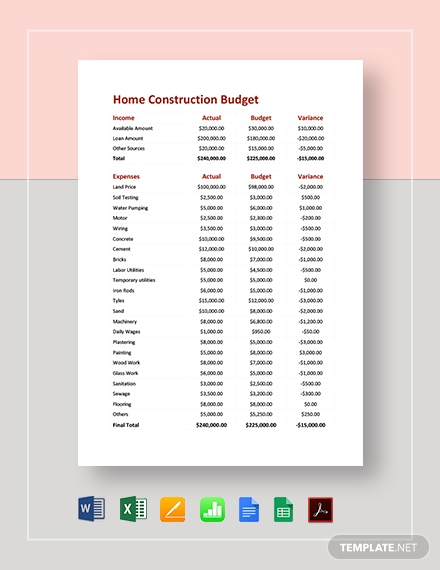

Here’s a look at how to build a new home budget and factor in homeownership costs, plus access to a free mortgage calculator. Our free interactive game makes it easier to make the right decision about your finances Ad learn more about our free interactive game about lifelong financial lessons.

If you earn a lot of money each month, you. Ordering a cost to build report from houseplans.com may be a better way to develop budgeting guideposts. Create a monthly budget for house budget plan.

The budget can be used to track. You can do this with squares. Taking the return on investment (roi) into account with home improvement projects can also help with developing a project budget.

To identify your net income, you need to determine what you’re taking home after taxes and any other deductions such as your 401 (k). If a project is likely to. The purpose of a household budget is to summarize what you earn against what you spend to help.