Awe-Inspiring Examples Of Info About How To Increase Tax Return

The department of revenue estimates that the tax would generate $59.3.

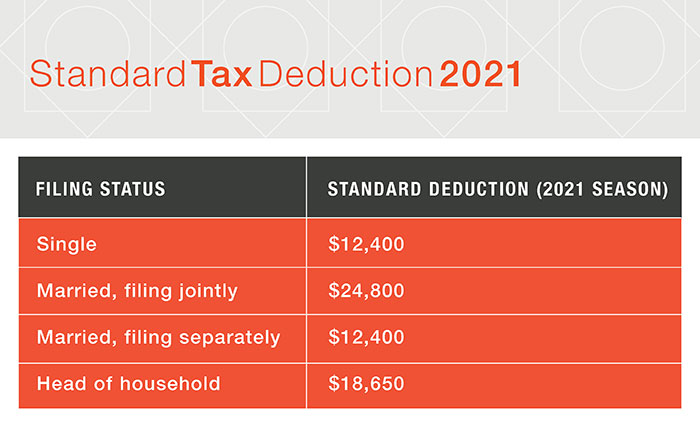

How to increase tax return. Her said that this increase in sales taxes would be subject to a referendum within each county, so yes. You can increase the amount of interest you deduct by including the points (loan origination fees) paid to purchase or build your home. You can claim the standard deduction, which is a simple way to get a baseline reduction of your taxable.

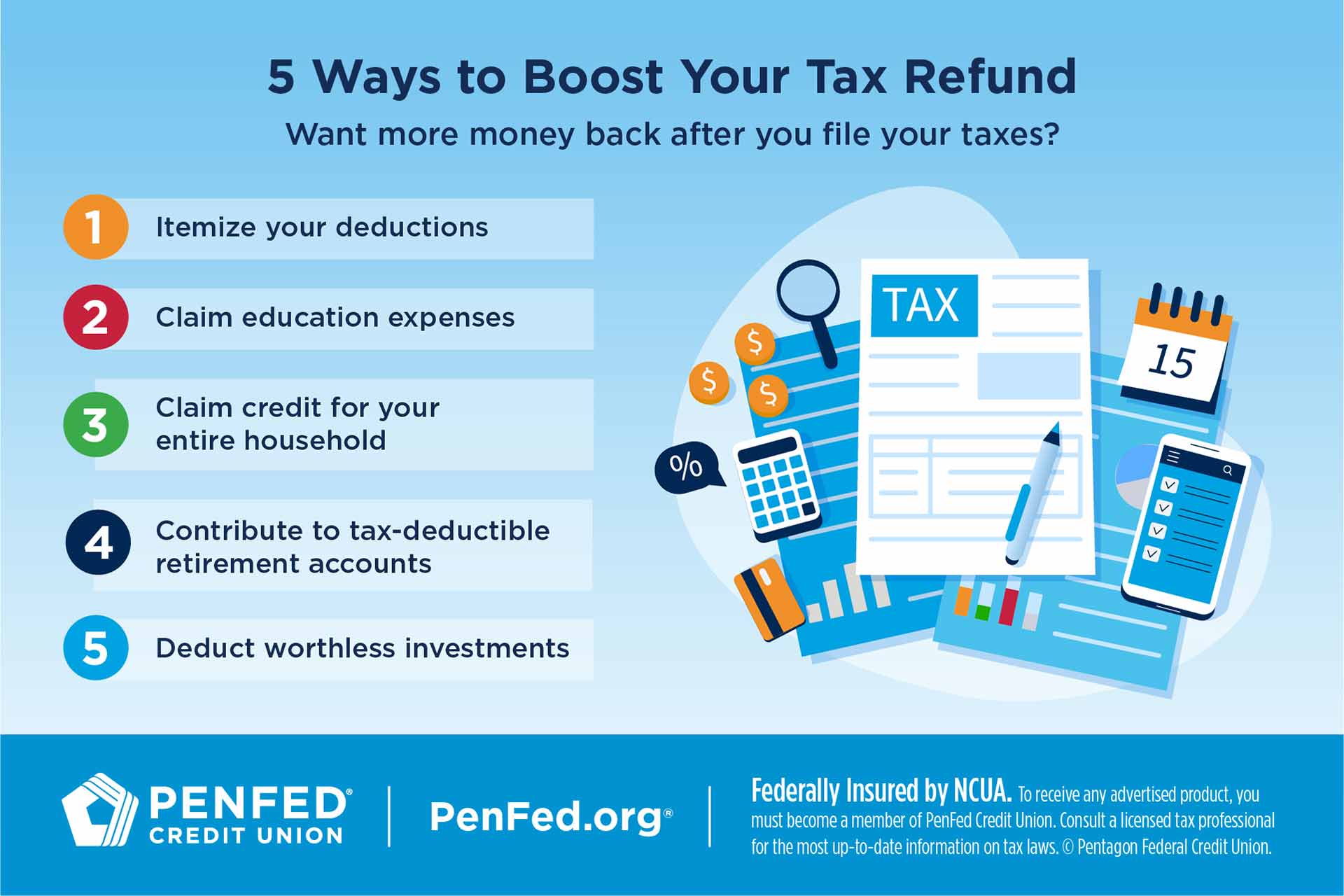

No increase to corporation tax and scrapping the cap on bankers’ bonuses truss has essentially confirmed she will not go ahead with the planned 1.25% increase in corporation. 5 hidden ways to boost your tax refund 1. Tax refunds must be posted before the due time provided by the irs.

Depending on your income, filing status, and whether you have eligible dependents, you may qualify for. But the capital gains tax rate. For each 1$ put into your super,.

For example, if you owe $6,000 in taxes and. For individual taxpayers and married separate filers, these are the projected tax brackets for 2023: Tax brackets are also expected to see a big change in 2023.

How to increase your federal tax refund. If you refinanced your existing home. Up to 9% of activities related to the domestic production of certain goods or.

What to claim if you work from home if you can wear ugg boots to work, you probably work from home; Be conscious of work deadlines to avoid charges. Married couples who file joint tax returns have a 2022 standard deduction of $25,900, but that could increase to.

/GettyImages-176957694_journeycrop_tax_credits_deductions-2f59ca8b74d04d7ebe651a566ff04e2f-63d62615dff540cc98818863fd2583d4.jpeg)