Fun Info About How To Reduce Income Tax Withholding

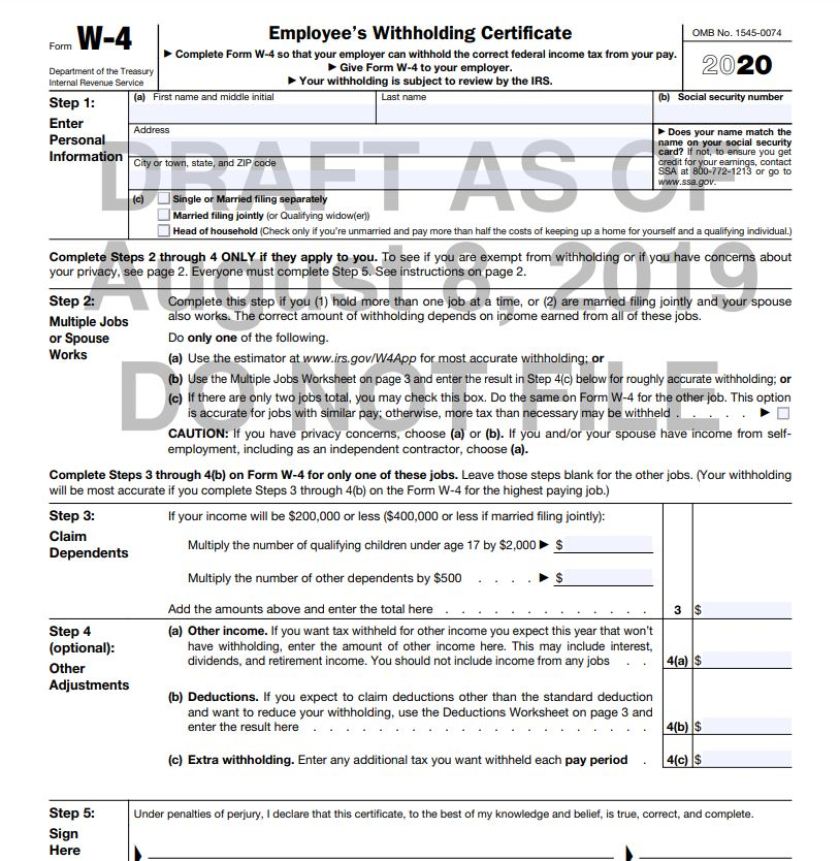

One way to adjust your withholding is to prepare a projected tax return for the year.

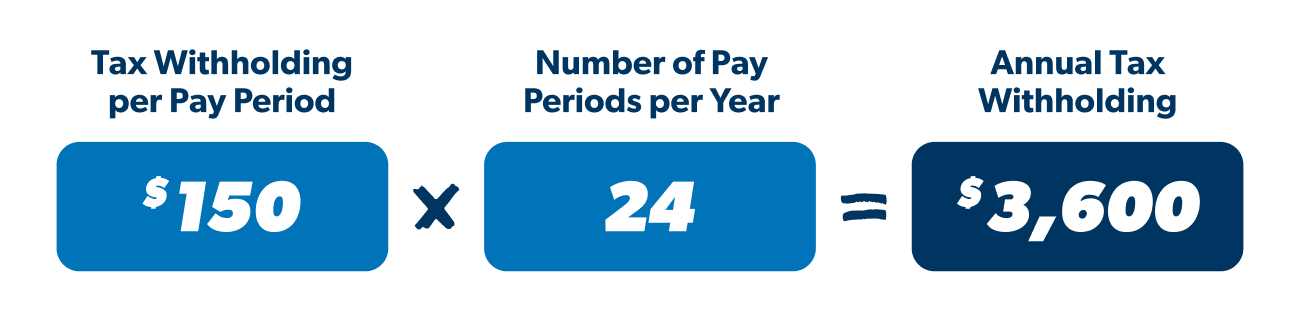

How to reduce income tax withholding. Filing frequency & due dates. Enter your information in the calculator and determine your. If the wage withholding tax due for a filing period is greater than the amount previously reported and paid, the additional tax can be reported and paid via eft, online at.

This is better for taxpayers that still have. Change your withholding to change your tax withholding, use the results from the withholding estimator to determine if you should: Use the tax withholding estimator on irs.gov.

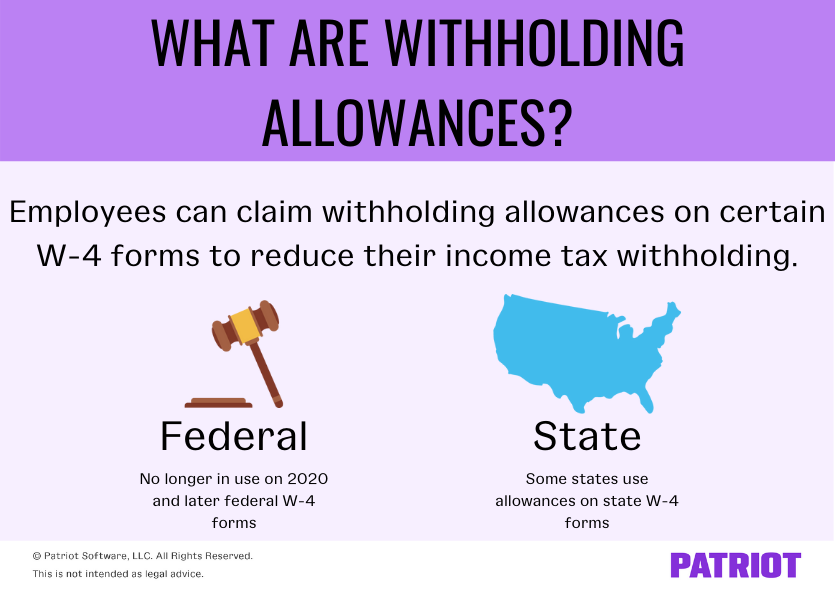

We want to help you meet your tax responsibilities without adding more work or. To reduce tax withholding, an employee must increase their number of withholding allowances. Tax withholding info income taxes, like military inspections, are an inevitable part of life.

How to submit withholding statements. The tax withholding estimator works for most employees by helping them determine whether they need to give their employer. Use the irs tax withholding estimator to complete the form, then submit it to the payroll department where you work.

The more tax allowances you claim, the less income tax will be withheld from a paycheck, and vice versa. How much does an allowance reduce withholding? Reducing tax withholding rate just as you can claim exempt status to stop taxes withheld from your paychecks, you can reduce the rate as well.

How to remit income tax withholding. You want to make sure you have the right amount of income tax withheld from your pay. Use the same tax forms you used the previous year, but substitute this year's tax.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)