Impressive Info About How To Start Payroll

Choose payroll software to record employee’s details, calculate pay and deductions,.

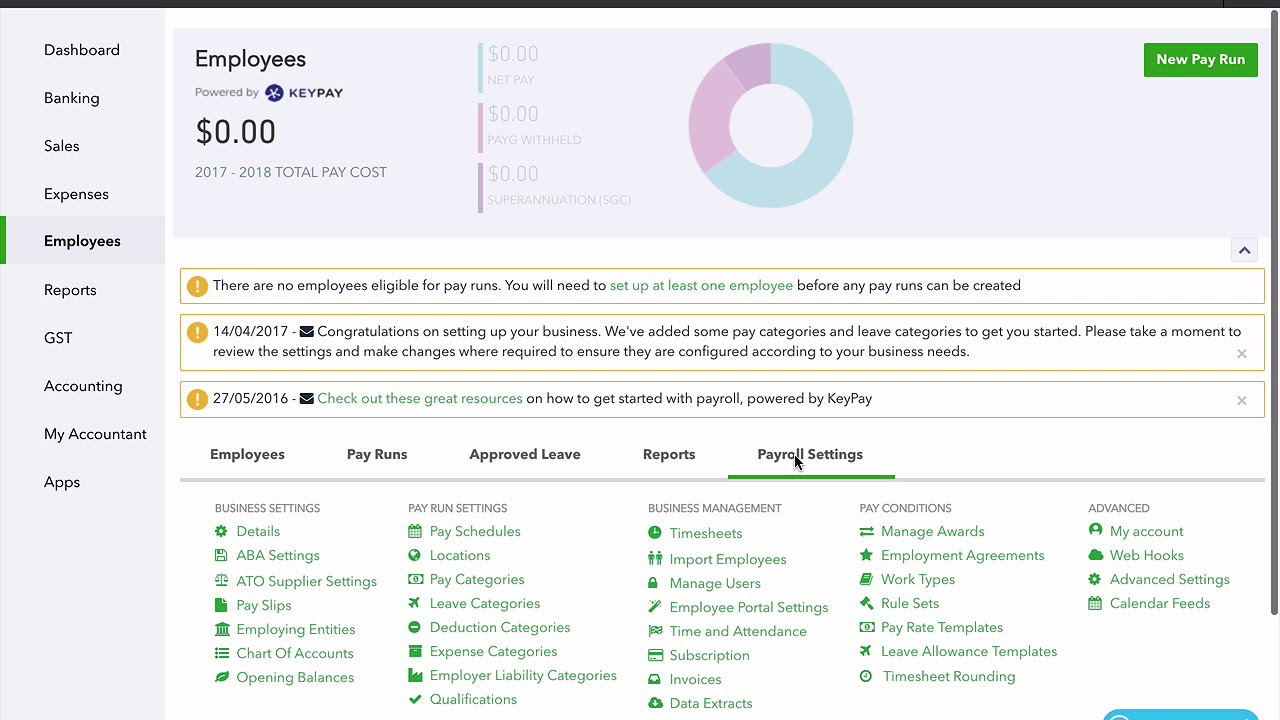

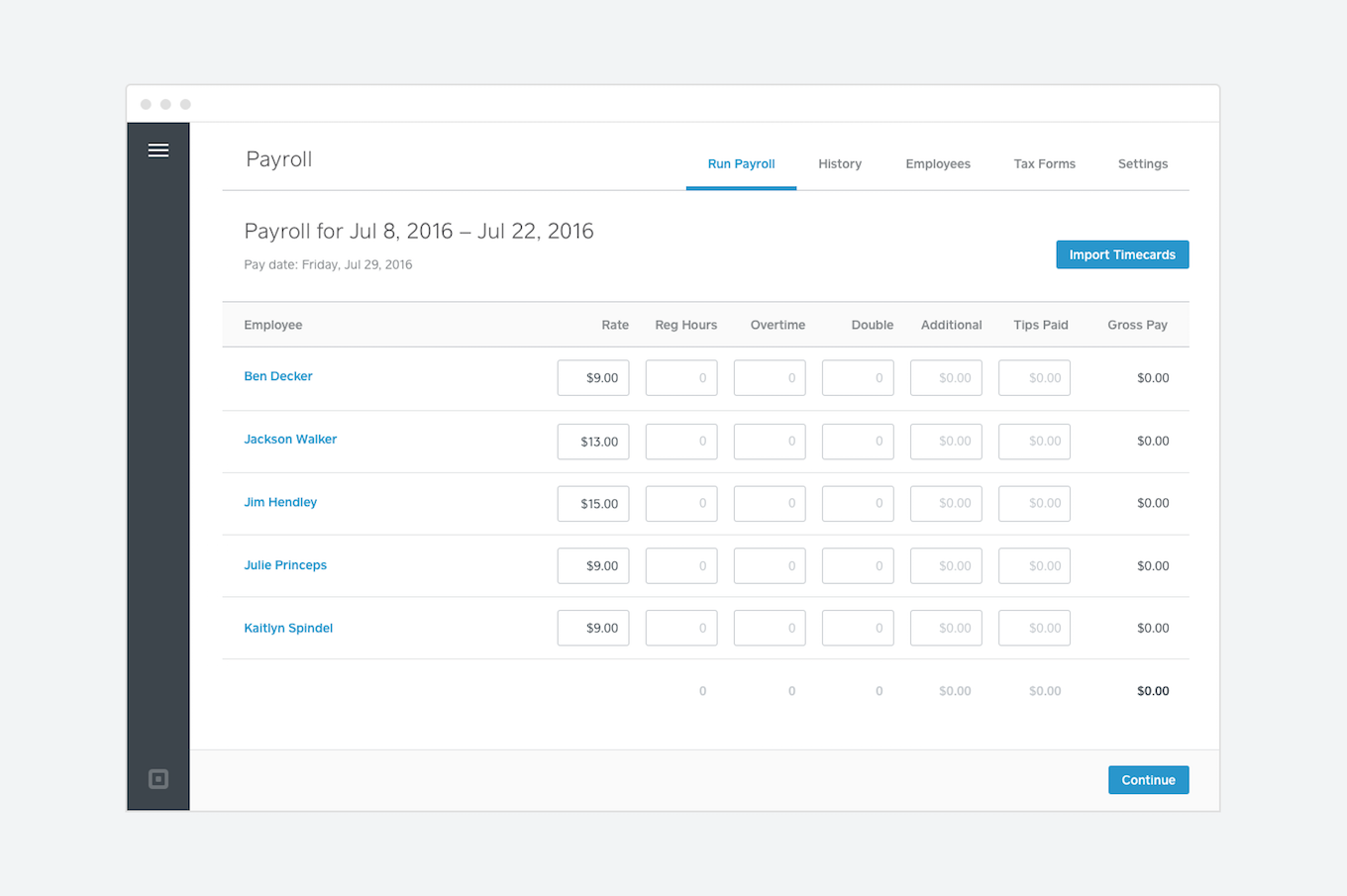

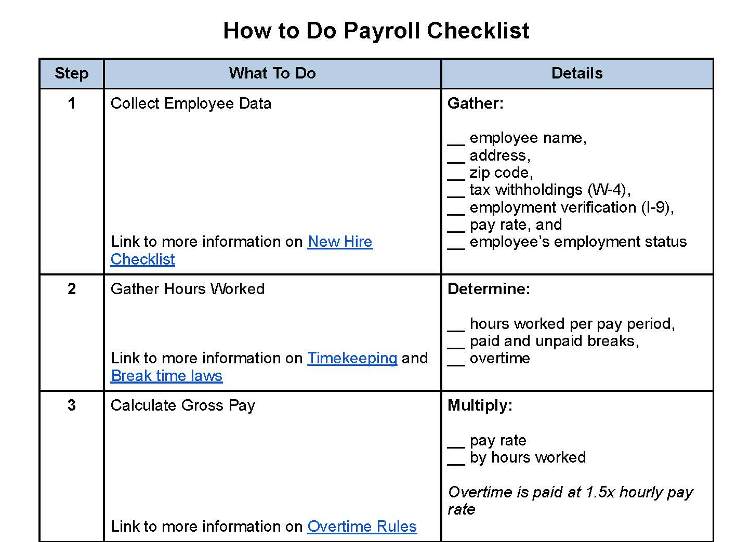

How to start payroll. Approve payroll when you're ready, access employee services & manage it all in one place. Go to payroll, then select overview. Determine your ein and tax codes.

If no requirements exist, employers are generally free to. Payroll seamlessly integrates with quickbooks® online. Get 3 months free payroll!

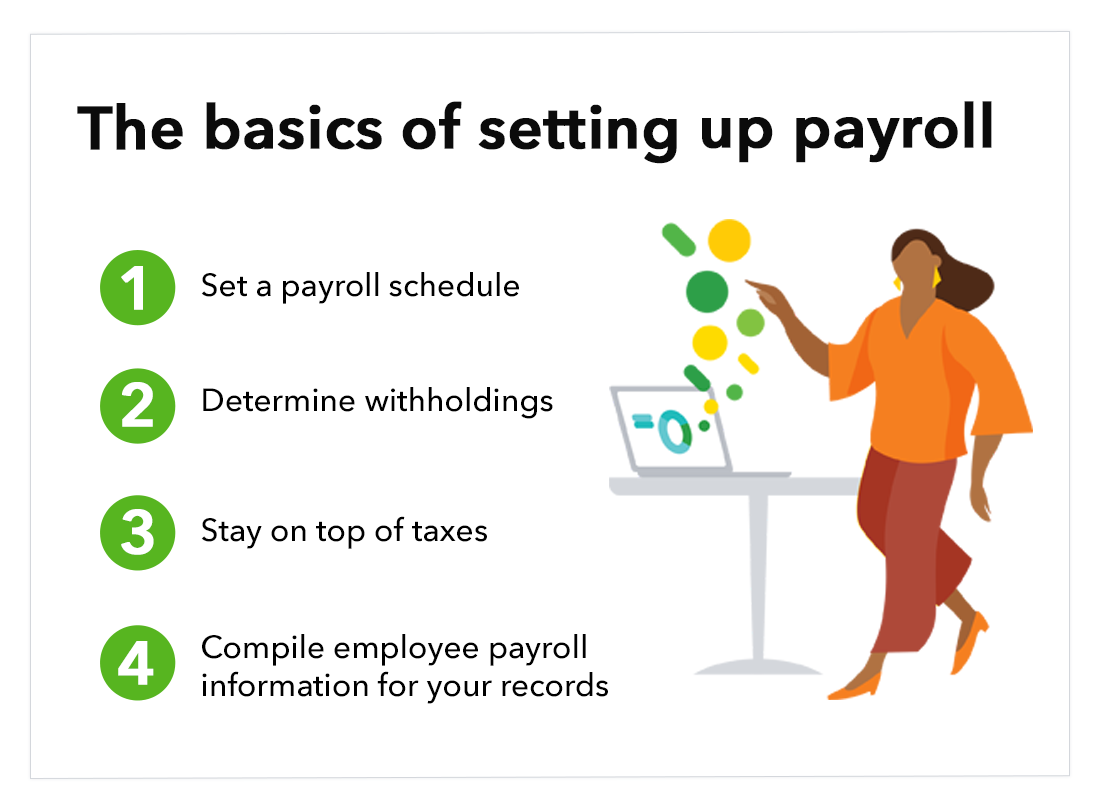

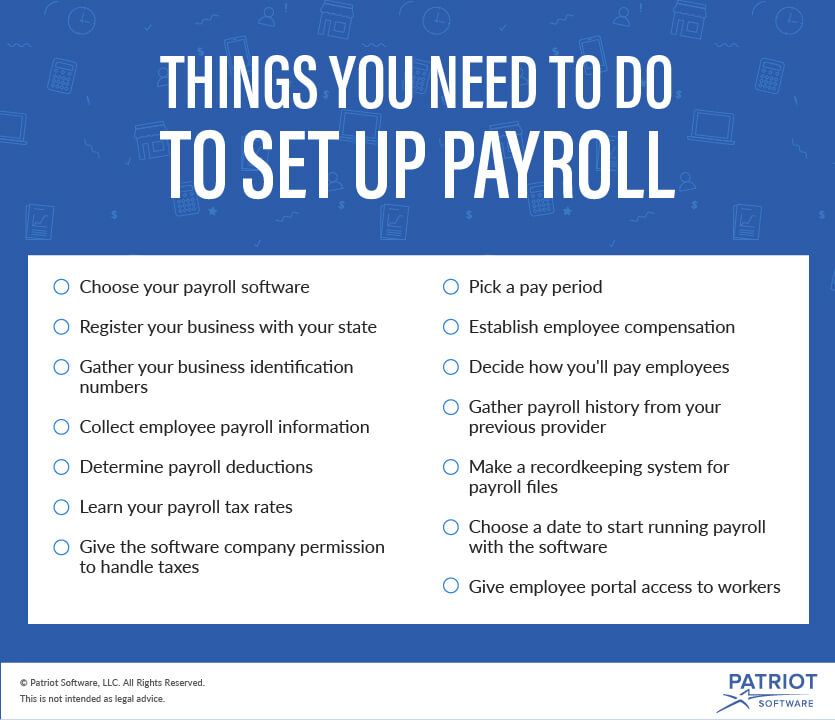

When it comes to starting a payroll processing company, the startup costs could range from $15,000 to over $150,000 depending on how much equipment the business owner decides to. First, you need to establish tax and registration information for your business. Select start on the task you want to work on.

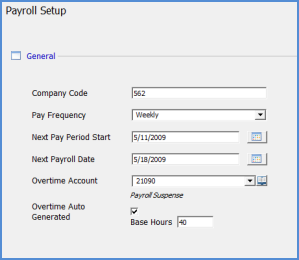

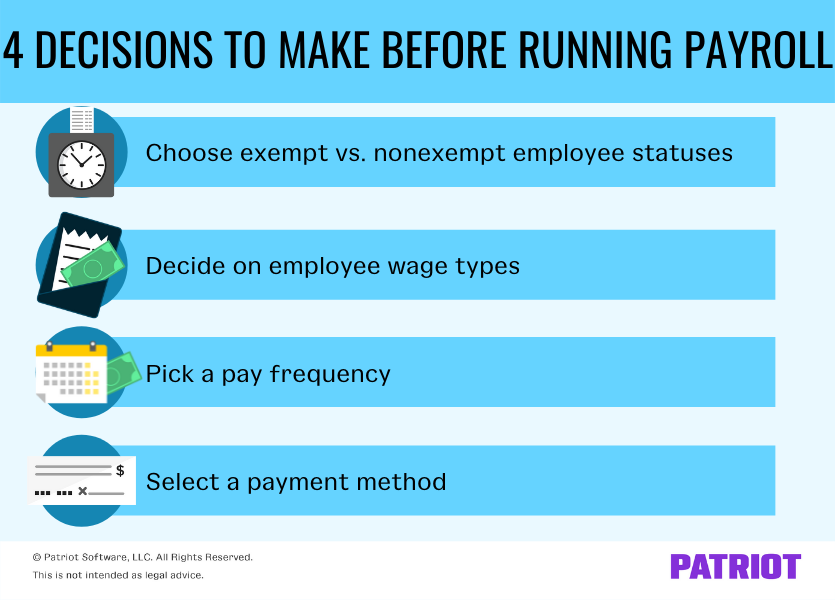

This includes getting your federal identification number, or fein, then establishing a payroll deposit. Payroll administration requires an acute attention to detail and accuracy, so it’s worth doing some research to understand your options. Begin by determining your employer identification number (ein) and tax codes.

Tell us about your team fill in your tax info add your payroll history (if you already paid. Establish your business as an employer; Advertise your business in relevant business.

Also called an ein or federal ein, this is a number issued by the irs for. Ensure you introduce your payroll business to potential clients by sending an introductory letter, contract document and business cards. Employers should review state laws on pay frequency when developing a payroll schedule.

.gif)